RISD Community Approved Tax Ratification Measure

On Nov. 6, 2018, RISD voters approved the district's proposed tax ratification measure. The measure will provide additional compensation for teachers and staff while adding teaching positions, security enhancements, special education support and more.

“We are thrilled with this election outcome and that our Richardson ISD community has, once again, demonstrated its commitment to and support of our students, teachers and schools,” said RISD Superintendent Dr. Jeannie Stone. “We are anxious to get to work implementing the measures we promised to the community. On behalf of our students, teachers, staff and the Board of Trustees, I want to say thank you to all.”

Overview

Richardson ISD Trustees Call Tax Ratification Election

Addresses School Safety, Class Sizes, Teacher Retention, Strategic Initiatives

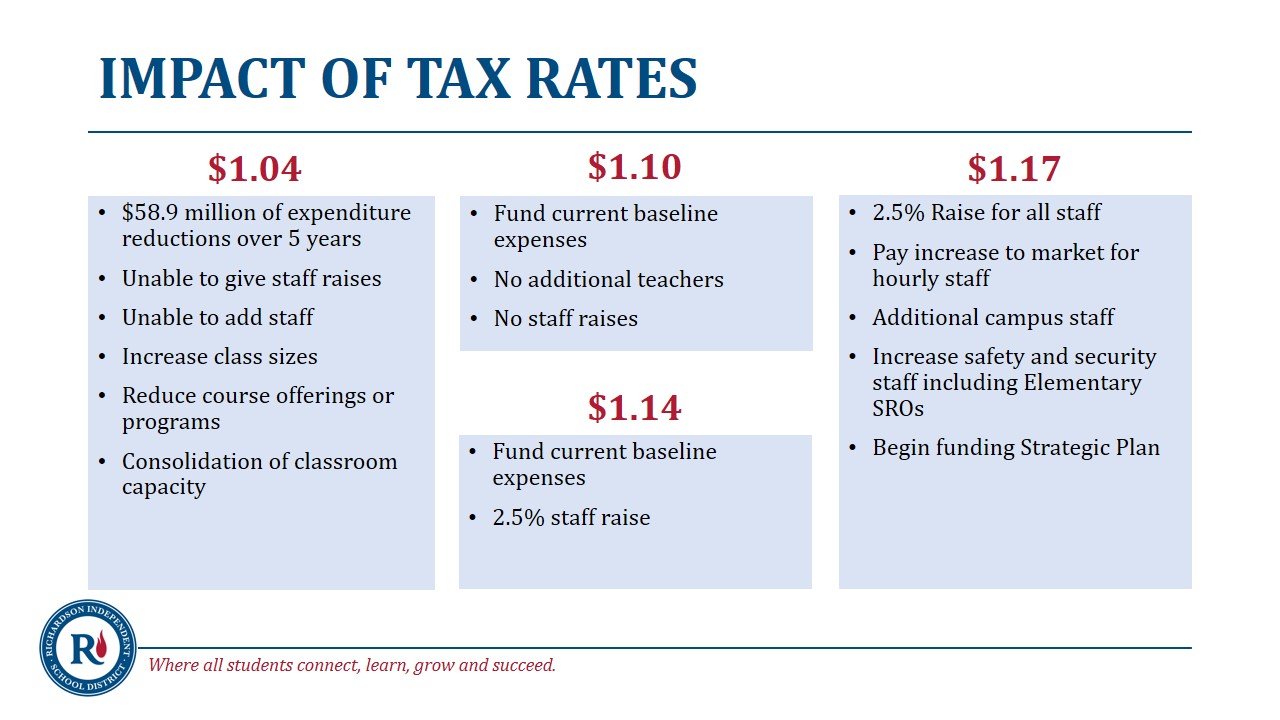

After months of budget discussion, and incorporating recommendations

from the comprehensive community and staff strategic planning process that began last

fall, the Richardson ISD Board of Trustees voted to set the district’s operating tax rate at

$1.17, triggering a tax ratification election (TRE) that will occur on November 6, asking voters to approve

an increased tax rate.

“For those who believe in safe schools, outstanding teachers, and maintaining a strong

district that meets the high expectations of our community, this action could no longer be

avoided,” said RISD Board President, Justin Bono. “From our highest achieving schools to

our campuses and students in need of additional resources, RISD can no longer operate

on the reduced state funding and revenue generated by a minimum operating tax rate.”

Frequently Asked Questions

-

What is a tax ratification election (TRE)?

A TRE is a special election called by a school district’s Board of Trustees, asking voters to approve an increase above the current operating tax rate. The operating tax rate in RISD has been $1.04 for the last 11 years (when it was lowered to the current rate). Voter approval through a TRE is required for a school district operating tax rate to exceed $1.04.

-

My home value keeps rising so I am paying more school taxes. Why is RISD asking for more money?

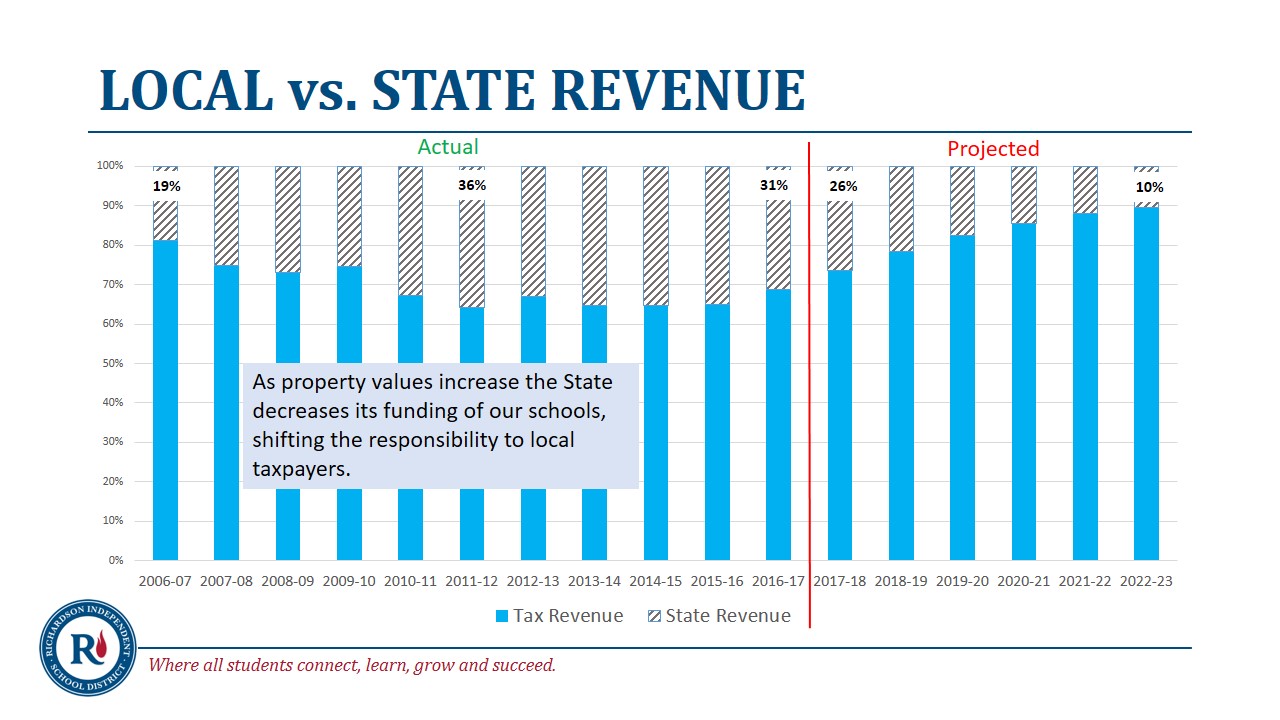

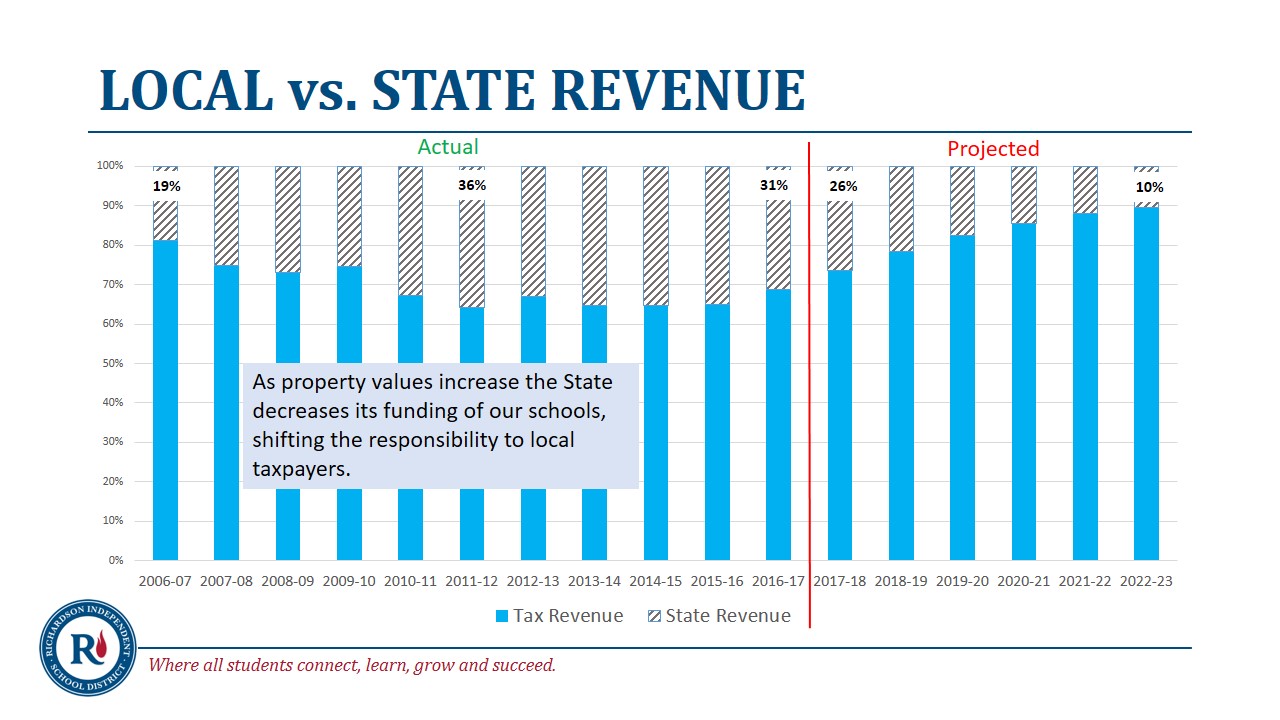

Unfortunately, the way school finance in Texas is set up by the legislature, while increases in RISD home values do cause a homeowner’s school taxes to rise, the increases do not provide an ongoing benefit to RISD’s operating budget. It actually has the opposite effect. As RISD collects more money from local taxpayers due to increased property values, state operating funding for RISD decreases. In fact, state officials have often used the benefit of additional local tax dollars generated in school districts like RISD to fund other parts of the state budget unrelated to public education.

-

Didn’t RISD just have a tax election in 2016?

RISD held a bond election in 2016, requesting voters approve a 5 cent debt service tax rate increase to provide funds for capital (long term) items like new classrooms, facilities, and equipment to accommodate physical needs primarily associated with RISD’s increased enrollment as well as growing programs in Career & Technical Education, Fine Arts and Athletics.

Under Texas law, school district tax rates are broken into two parts, and each generates funds used for different things. The larger portion is the operating (M & O) tax rate, which is used to fund the ongoing, recurring (short term) expenses of operating a school district, such as teacher salaries and utilities. This is the portion of the tax rate that RISD is asking voters to increase through the TRE.

The second portion of the tax rate is the debt service (I & S) tax rate, which may only be used to pay back bonds that are sold to finance the longer term capital items for a school district, such as construction, infrastructure, technology, and equipment for programs. Funds generated from the debt service tax rate may never be used to pay the operational costs of a school district, such as teacher salaries.

The TRE would increase the operating tax rate to provide more operating funds for RISD.

Surrounding school districts like Allen, Carrollton-Farmer’s Branch, Plano, McKinney, and Wylie have all passed tax ratification elections to provide more operating dollars for their districts. -

How much will the TRE cost homeowners?

The average home’s market value in RISD is $288,794. After homestead exemptions, the average home’s taxable value in RISD is $234,915. If approved, the 13-cent change would raise property taxes by $25.45 a month, or the cost of two tickets to the movies. The $305 annual cost is $0.84 per day.

The market value of homes in RISD is determined by the Dallas Central Appraisal District (www.dallascad.org). The taxable value of a home is the market value, minus the two homestead exemptions that are offered – the state’s standard $25,000 exemption and the 10% local optional homestead exemption offered by RISD (RISD is one of three districts of the 38 in Dallas and Collin counties to still provide taxpayers with a local optional homestead exemption).

The tax levy impact of a 13 cent increase in the operating tax rate will vary based on a home’s assigned market value:

*Average 2018 market value of a home in RISD, per DCAD.Market Value Tax Impact** $100,000 $84/year or $7/month $150,000 $143/year or $11.91/month $200,000 $201/year or $16.75/month $250,000 $260/year or $21.66/month $288,794* $305/year or $25.45/month $300,000 $318/year or $26.50/month $350,000 $377/year or $31.42/month $400,000 $435/year or $36.25/month $450,000 $494/year or $41.16/month $500,000 $552/year or $46/month

**No tax impact on homeowners age 65+ who have a frozen tax levy.- How will RISD use the increased funds from a TRE?

If voters pass the TRE, funds would be used to:

- Provide additional teaching and staff positions to serve students in special education and those with special needs

- Provide additional school resource officers and district safety and security staff.

- Increase salary compensation for teachers and staff by 2.5%

- Adjust the hourly rate for custodial, other classified employees and paraprofessionals to be more competitive with the market and surrounding districts

- Maintain class sizes without overage waivers

- Implement future priorities from the 2017-18 community strategic planning process

- Is RISD eliminating the local optional homestead exemption?

No. RISD is one of three remaining school districts among the 38 in Dallas and Collin counties to still provide taxpayers a local optional homestead exemption (LOHE). This exemption, which is provided in addition to the standard state homestead exemption, allows RISD homeowners to reduce the taxable value of their home by 10%, which reduces the amount of property taxes paid.

Dr. Stone and RISD trustees have stated that the district has not considered elimination of the LOHE and has no current intention to do so. Under current Texas law, RISD trustees could not take any action to eliminate or reduce the LOHE until 2020 or after.

The group of community and staff members who worked throughout the 2017-18 school year on RISD's strategic planning finance action team recommended that RISD consider different available options to increase revenue. That included a recommendation to consider a tax ratification election to seek voter approval to raise the operating tax rate. Elimination of the local optional homestead exemption was among other items for RISD to consider as ways to increase operating revenue.

The finance action team recommendations were specifically discussed at RISD's September 10, 2018 Board meeting. Trustees made clear that eliminating the local optional homestead exemption is not under consideration, and increasing operating revenue through a tax ratification election is the method RISD is pursuing to generate additional revenue, along with maximizing grant funding opportunities and operating as efficiently as possible with current resources.

For an average-value home in RISD, the local optional homestead exemption currently reduces annual property taxes by $300. If the TRE were to pass, RISD’s local optional homestead exemption would reduce annual property taxes on an average-value district homestead by $338. Providing the LOHE benefit to RISD taxpayers costs RISD approximately $8.3 million annually in operating revenue.

Tax Ratification Election (TRE)

- What is a tax ratification election (TRE)?

A TRE is a special election called by a school district’s Board of Trustees, asking voters to approve an increase above the current operating tax rate. The operating tax rate in RISD has been $1.04 for the last 11 years (when it was lowered to the current rate). Voter approval through a TRE is required for a school district operating tax rate to exceed $1.04.

- How much is the proposed tax rate increase?

After a seven-month strategic planning process with community members and staff, RISD Trustees are recommending 13 cents be added to the operating tax rate, resulting in a rate of $1.17. This would accommodate RISD’s operating budget until at least 2023 and allow the district to sustain current operations, while also introducing community recommendations from the Strategic Planning 2017 process. Coupled with RISD’s current debt service tax rate of $0.35, increasing the operating tax rate to $1.17 would make RISD’s combined tax rate $1.52.

- How will the TRE affect taxpayers who are over 65 or disabled?*

The TRE won’t affect taxpayers who have a frozen tax levy. The amount of property taxes paid (the tax levy) by citizens 65 years or older—or those who are disabled—are generally not affected by rate increases, if the appropriate homestead exemptions are filed with the county appraisal district to freeze their tax levy. RISD taxpayers can verify their exemptions with the Dallas Central Appraisal District at www.dallascad.org or 214-631-0910.

- How much will the TRE cost homeowners?

The average home’s market value in RISD is $288,794. After homestead exemptions, the average home’s taxable value in RISD is $234,915. If approved, the 13-cent change would raise property taxes by $25.45 a month, or the cost of two tickets to the movies. The $305 annual cost is $0.84 per day.

The market value of homes in RISD is determined by the Dallas Central Appraisal District (www.dallascad.org). The taxable value of a home is the market value, minus the two homestead exemptions that are offered – the state’s standard $25,000 exemption and the 10% local optional homestead exemption offered by RISD (RISD is one of three districts of the 38 in Dallas and Collin counties to still provide taxpayers with a local optional homestead exemption).

The tax levy impact of a 13 cent increase in the operating tax rate will vary based on a home’s assigned market value:

*Average 2018 market value of a home in RISD, per DCAD.Market Value Tax Impact** $100,000 $84/year or $7/month $150,000 $143/year or $11.91/month $200,000 $201/year or $16.75/month $250,000 $260/year or $21.66/month $288,794* $305/year or $25.45/month $300,000 $318/year or $26.50/month $350,000 $377/year or $31.42/month $400,000 $435/year or $36.25/month $450,000 $494/year or $41.16/month $500,000 $552/year or $46/month

**No tax impact on homeowners age 65+ who have a frozen tax levy.- How is a homeowner’s school property tax rate calculated?

The tax rate is assessed per $100 of a home’s taxable value. Using RISD’s current combined tax rate of $1.39 (which is $1.04 operating + $0.35 debt service), the school taxes on an average value RISD homestead would be calculated as follows:

To calculate how much the TRE would increase the taxes levied on an average value RISD home, multiply the taxable home value per $100 by the new proposed rate of $1.52 and subtract the current tax levy from the result:$288,794 Average market value of home in RISD -$25,000 Standard Texas homestead exemption -$28,879 Local optional homestead exemption (only offered by RISD and two other area districts) -$234,915 Average taxable value of home in RISD ÷ 100 Calculation to reduce total taxable value to per $100 value $2,349 Taxable home value per $100 of average RISD home X 1.39 RISD’s current tax rate $3,265 Tax levy on average value RISD home at current rate

Note that residents who are 65+ years old or disabled will not be impacted by a tax increase if the appropriate exemptions have been granted by the Appraisal District. RISD taxpayers with questions are welcome to contact the RISD Tax Office at 469-593-0500.$2,349 Taxable home value per $100 of average RISD home X 1.52 RISD’s proposed new tax rate with the $0.13 operating tax rate increase $3,570 Tax levy on average value RISD home at proposed rate -$3,265 Tax levy on average value RISD home at current rate $305 Proposed tax increase on average value RISD home - What other school districts have passed a TRE?*

Locally, Plano ($1.17), Allen ($1.14), McKinney ($1.17), Carrollton-Farmers Branch ($1.17), Irving ($1.17), Wylie ($1.17), Coppell ($1.17), DeSoto ($1.17) and Grand Prairie ($1.17) ISDs have raised their operating tax rate in the last decade.

Of the 38 area districts in Dallas and Collin counties, 25 (two-thirds) have passed a TRE. Additional area districts are considering TREs as funding from the state decreases. Since 2006, more than 500 Texas school districts have called a TRE.- Didn’t RISD just have a tax election in 2016?*

RISD held a bond election in 2016, requesting voters approve a 5 cent debt service tax rate increase to provide funds for capital (long term) items like new classrooms, facilities, and equipment to accommodate physical needs primarily associated with RISD’s increased enrollment as well as growing programs in Career & Technical Education, Fine Arts and Athletics.

Under Texas law, school district tax rates are broken into two parts, and each generates funds used for different things. The larger portion is the operating (M & O) tax rate, which is used to fund the ongoing, recurring (short term) expenses of operating a school district, such as teacher salaries and utilities. This is the portion of the tax rate that RISD is asking voters to increase through the TRE.

The second portion of the tax rate is the debt service (I & S) tax rate, which may only be used to pay back bonds that are sold to finance the longer term capital items for a school district, such as construction, infrastructure, technology, and equipment for programs. Funds generated from the debt service tax rate may never be used to pay the operational costs of a school district, such as teacher salaries.

The TRE would increase the operating tax rate to provide more operating funds for RISD.

Surrounding school districts like Allen, Carrollton-Farmer’s Branch, Plano, McKinney, and Wylie have all passed tax ratification elections to provide more operating dollars for their districts.

Why a TRE

- What is guiding RISD’s decision to pursue a TRE?

Many factors and months of study went into the decision to present a TRE to RISD voters, but the bottom line is due to ongoing reductions in state funding, RISD’s long time $1.04 operating tax rate is no longer sufficient to fund the district in a way that meets the district's mission and community expectations for a high quality education.

From a revenue standpoint, the state has reduced its portion of funding to RISD by $16.1 million since 2013, and is projected to decrease another $41.8 million over the next five years. RISD’s operating tax rate has remained unchanged for 11 years and is at a 27 year low.

From a cost standpoint, RISD’s student population is more expensive to educate than at any point in district history, with 54% of students economically disadvantaged and 26% of students with a limited understanding of English. Costs of utilities and salaries have risen steadily, which is necessary to recruit and retain quality educators. RISD continues to lose experienced and talented educators to school districts that have more resources due to higher operating tax rates.

Ninety percent of RISD’s operating budget is comprised of salaries, and even a 2.5% cost of living increase to teachers and staff will increase the operating budget by more than $6.6 million.- Did the 2017-18 budget use savings to meet operational needs?

Yes. Last year, RISD used $6.3 million of one-time savings to meet operating expenses. This was necessary to provide teachers and staff with a three percent pay raise, and pay utility, insurance and other operating costs. At the time the budget was approved, the Texas legislature was still debating increases to education funding, and the Board felt it was prudent to wait on the outcome of the legislative session before considering a TRE to increase operational funding. The legislature did not provide additional funding in the 2017 session, and with state funding obligated to pay for Hurricane Harvey recovery costs a priority for the 2019 session, RISD could no longer afford to wait on legislative help.

For this reason, considering a TRE became necessary to meet baseline budgetary needs, provide instructional support to students with special needs, enhance overall school safety, and provide teachers/staff with a 2.5% cost of living raise.- Has the community been involved in evaluating RISD’s needs and arriving at the decision to pursue a TRE?

Yes. More than 300 people began studying RISD and planning for its future last fall as part of the 2017 Strategic Planning Process. The comprehensive strategic plan committee included teachers, staff, students, parents, and community members.

Six action teams looked in-depth at every major aspect of how RISD functions and operates, arriving at a series of recommendations designed to guide RISD into the next decade.

The finance strategic planning action team determined that the current $1.04 operating tax rate does not generate enough revenue to meet current or future district needs, and recommended the Board consider increasing the operating tax rate to preserve current programs and begin funding priority strategic planning initiatives.

Some priority recommendations from the strategic planning process are reflected in the 2018-19 operating budget that is contingent upon passage of the TRE.

For more information about RISD’s strategic planning process, visit risd.org/sp17- Did any RISD Board member vote against raising the operating tax rate, which triggered the tax ratification election to allow voters to approve/not approve the increase?*

The RISD Board vote was 6-1, with trustee Eron Linn voting against.

Impact of Passed TRE

- How will RISD use the increased funds from a TRE?

If voters pass the TRE, funds would be used to:

- Provide additional teaching and staff positions to serve students in special education and those with special needs

- Provide additional school resource officers and district safety and security staff.

- Increase salary compensation for teachers and staff by 2.5%

- Adjust the hourly rate for custodial, other classified employees and paraprofessionals to be more competitive with the market and surrounding districts

- Maintain class sizes without overage waivers

- Implement future priorities from the 2017-18 community strategic planning process

Impact of Failed TRE

- What would be the impact of a failed TRE?

If voters do not approve the TRE, the district would be unable to fund strategic planning initiatives or teacher compensation increases, and would also be facing an operating budget deficit of a projected $54.1 million over the next five years. Addressing that deficit would impact current programs and staffing allocations.

Examples of actions that would be considered if the TRE fails include:

Unable to give teacher/staff salary compensation increase

RISD continues to lose experienced and talented educators to school districts that have more resources due to higher operating tax rates. Ninety percent of RISD’s operating budget is comprised of salaries, and even a 2.5% cost of living increase to teachers and staff will increase the operating budget by more than $6.6 million.

Unable to add all teachers/staff necessary to serve students

Ninety percent of RISD’s operating budget is comprised of salaries, and a hiring freeze is the most immediate action that could be taken to reduce operating costs.

Increased class sizes

See next FAQ.

Unable to add school resources officers or security guards

Strategic planning recommendations call for additional security personnel, including police officers to support elementary clusters.

Reduced course offerings or programs

Addressing a projected operating deficit of $54.1 million over five years could not be done without directly impacting classrooms, courses and/or programs. In addition to an impact on class sizes, a hiring freeze would impact the number and availability of teachers in certain subject areas, which could impact course offerings.

Consolidation of classroom capacity where feasible

Classroom capacity at most RISD schools is well utilized, especially given enrollment growth over the last decade. However, some schools remain underutilized, and could be evaluated for consolidation as a cost-cutting measure.

Fees for co- and extracurricular activities

Charging students fees to participate in extra-curricular activities like athletics and fine arts is an option to generate revenue. It would impact participation, and is a barrier for many families who are economically disadvantaged (54% of RISD families).- How Does a Hiring Freeze Impact Class Sizes?

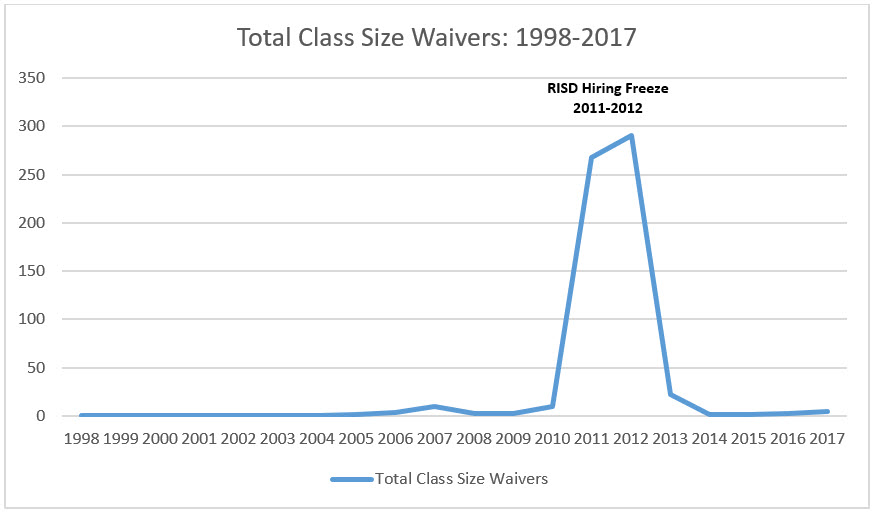

RISD has long been committed to maintaining reasonable class sizes. Like many school districts, a very high portion (90%) of RISD’s operating budget is allocated to payroll. If the TRE is not successful, RISD will have to implement a hiring freeze as one way to address a projected operating budget deficit of $54.1 million over the next five years. A hiring freeze means that the positions vacated through normal teacher and staff turnover are not replaced. This leaves fewer teachers and staff members to serve a growing student population, resulting in larger class sizes.

The state of Texas caps the number of students in Kindergarten through 4th grade classrooms at 22, and RISD’s guideline for 5th & 6th grade classrooms is a maximum of 28 students. With fewer teachers to serve students, RISD will be forced to exceed those caps with larger class sizes. When the class size cap is exceeded in grades K-4, school districts must request a waiver from the state of Texas for each classroom over the cap.

Because of RISD’s commitment to reasonable class sizes, the district has requested very few class size waivers over the years. The major exception came the last time that RISD implemented a hiring freeze, which occurred in 2011-2012 as a consequence of reductions in state funding. During that period, the number of waivers to exceed the maximum state class size grew from 10 waivers in the fall of 2010 to a combined 559 waivers in 2011 and 2012 (see chart).

School Taxes & Rates

- What makes up a school district’s tax rate?

Two tax rates combine to make a school tax rate. The first tax rate is the operating tax rate. RISD’s is currently $1.04 and is used to fund day-to-day operations, such as payroll costs, utilities, and maintenance of schools and facilities.

The second part is the debt service tax rate, currently $0.35. It may only be used to pay for district bonds that fund construction and one-time purchases such as technology, vehicles, and equipment with a useful life of more than one year. The bonds that are funded by the debt service tax rate are much like the mortgage on a home, but in RISD are paid back more quickly to reduce interest costs.

The two rates combined make up the current RISD tax rate of $1.39.- How long has the operating tax rate been $1.04?*

The operating tax rate has been at $1.04 since 2007-08, and is at its lowest rate since 1990-91, or 27 years.

- How high has RISD’s operating tax rate been?*

RISD’s highest-ever operating tax rate was $1.50, most recently in 2005-06.

- What is the operating tax rate of other districts in the area?

The average operating tax rate of the 38 districts in Dallas and Collin counties is $1.12. Area districts like Plano ($1.17), Allen ($1.14), McKinney ($1.17), Carrollton-Farmers Branch ($1.17), Irving ($1.17), Wylie ($1.17), Coppell ($1.17), DeSoto ($1.17) and Grand Prairie ($1.17) have raised their operating tax rate in the last decade.

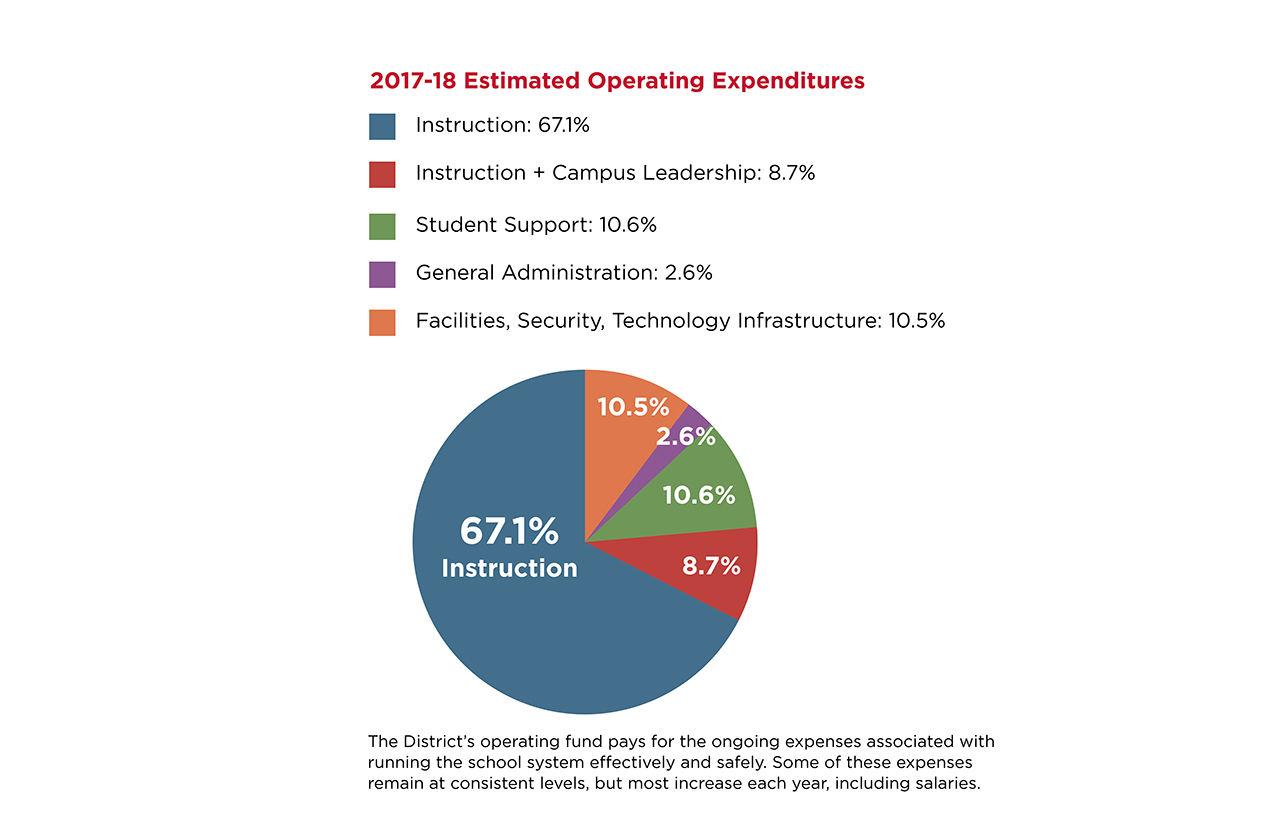

- What comprises the RISD Maintenance and Operations (M&O) budget?

A school district M&O budget (commonly called the operating budget) is comprised mostly of personnel. Ninety percent of RISD’s operating budget is comprised of teacher and employee salaries. The chart below shows the percentages of the RISD operating budget, which is funded by the operating tax rate.

- Is RISD eliminating the local optional homestead exemption?*

No. RISD is one of three remaining school districts among the 38 in Dallas and Collin counties to still provide taxpayers a local optional homestead exemption (LOHE). This exemption, which is provided in addition to the standard state homestead exemption, allows RISD homeowners to reduce the taxable value of their home by 10%, which reduces the amount of property taxes paid.

Dr. Stone and RISD trustees have stated that the district has not considered elimination of the LOHE and has no current intention to do so. Under current Texas law, RISD trustees could not take any action to eliminate or reduce the LOHE until 2020 or after.

The group of community and staff members who worked throughout the 2017-18 school year on RISD's strategic planning finance action team recommended that RISD consider different available options to increase revenue. That included a recommendation to consider a tax ratification election to seek voter approval to raise the operating tax rate. Elimination of the local optional homestead exemption was among other items for RISD to consider as ways to increase operating revenue.

The finance action team recommendations were specifically discussed at RISD's September 10, 2018 Board meeting. Trustees made clear that eliminating the local optional homestead exemption is not under consideration, and increasing operating revenue through a tax ratification election is the method RISD is pursuing to generate additional revenue, along with maximizing grant funding opportunities and operating as efficiently as possible with current resources.

For an average-value home in RISD, the local optional homestead exemption currently reduces annual property taxes by $300. If the TRE were to pass, RISD’s local optional homestead exemption would reduce annual property taxes on an average-value district homestead by $338. Providing the LOHE benefit to RISD taxpayers costs RISD approximately $8.3 million annually in operating revenue.- Can RISD commit to maintaining the local optional homestead exemption if the TRE is successful?**

Dr. Stone and current RISD trustees have not considered elimination of the local optional homestead exemption and have no current intention to do so. Under current Texas law, RISD trustees cannot take any action to eliminate or reduce the exemption until 2020.

- Did RISD Consider a Tax Swap, like Frisco ISD?*

Yes. A tax swap is a term used for combining an operating tax increase with a promised decrease in the debt service tax rate. A tax swap can result in more operating funds for a district at a lesser overall tax rate increase or even without changing the overall lower tax rate. The RISD Board considered a swap and drop but chose not to pursue it. RISD is in a different financial situation than Frisco, primarily because of taxable value.

Frisco ISD still has substantial undeveloped land that is being developed, whereas Richardson ISD is effectively built out. Frisco ISD’s growth in taxable value is the result of additional property being added to the tax roll as well as the value of existing property increasing. Richardson ISD’s taxable value growth is due primarily to the value of existing property increasing.

In 2014, when Frisco ISD passed its most recent bond election, the total taxable value of FISD properties was $20.1 billion. By 2017 the taxable value had grown to $30.6 billion, an increase of 52% in 3 years.. Frisco’s debt service fund balance was $107,502,072 at June 30, 2017, representing 78% of their 2018 debt service. Richardson’s June 30, 2017 debt service fund balance was $24,028,455, representing 35% of RISD’s 2018 debt service. FISD’s very substantial growth allowed that district the ability to accelerate repayment of their bond program, freeing up the capacity to drop the debt service tax rate.

RISD’s last bond election was in 2016. From 2015-16 to 2017-18, Richardson ISD’s taxable value of all properties has grown by 20% ($3.6 billion). Richardson ISD is on a cycle of calling bond elections every five years, with the next election anticipated in 2021. The strategic planning team has recommended a comprehensive facilities study as well as consideration of programmatic changes that could impact facilities. Additionally, construction costs have increased across the state and nation, which impacts the scope and cost of projects. These factors contributed to the decision to leave the debt service tax rate at its current level pending completion of the facilities study and the recommendation of the bond study committee.- At what tax rate are businesses and apartments taxed?*

Property used by businesses and apartments are commercial properties and are taxed at the same rate as residential properties. The difference is that commercial properties do not qualify for the standard Texas homestead exemption or RISD’s local optional homestead exemption. Apartment property owners are assessed property taxes. Individuals who rent the apartments are not assessed property taxes because they do not own the property, however, property tax is part of the cost included by rent. Some commercial properties owned by public or some not-for-profit entities (such as city parks or fire stations) are exempt from property taxes but are still listed on tax rolls.

- How long would funding a successful TRE sustain the district before taxpayers are asked for more funding?*

If the TRE is approved, RISD’s operating tax rate could not be raised further under current state law. RISD would become the 23rd of 38 school districts in Dallas and Collin counties to have an operating tax rate of $1.17 and the 26th to have passed a TRE.

- If residents over 65 years old were to pay $1.10, how much help would that be?*

Homeowners over 65 are exempt from having their property tax levy increased beyond the point it was frozen when the homeowner turned 65. There is not a process for a taxpayer to choose to pay at a higher tax rate.

- If the last TRE vote/increase was in 2008 and we knew expenses were rising, why didn't we have TRE votes incrementally like we do bond elections?*

There was not a TRE or a tax rate increase in 2007-2008 – that year was the last time RISD’s operating tax rate changed, and it went from $1.33 to $1.04 due to changes in state law known as ‘compression.’

Under the school finance system, RISD was able to meet operating expenses over the last decade at the $1.04 rate because of student enrollment growth, a conservative fiscal philosophy, and a relatively higher share of operating funding from the state. What has changed in recent years is the substantial growth in property values to historic high levels, which under the school finance system continues to reduce the state share of operating funds to RISD. Moving forward, financial projections from RISD’s CFO call for a reduction in the state’s share of funding to RISD of $41.8 million over the next five years.

Some area school districts approached their communities for a tax rate increase via a TRE after the law changed a decade ago that permitted ISDs to do so. Since 2008, 22 other school districts in Dallas and Collin counties have raised their operating tax rates through TREs, including many that RISD directly competes against for quality teachers and staff. RISD has not pursued incremental increases because the funds have not been projected to be needed until now, and the RISD board has been committed to keeping the operating tax rate low.- What is the strategic plan moving forward? Is a gradual, consistent tax increase being considered and does the plan include a future decrease in the debt service tax rate?*

Information about RISD’s comprehensive strategic plan that was created during the 2017-18 school year by more than 300 members of the RISD community. If the TRE is approved, RISD will not be able to increase the operating tax rate further under Texas law. RISD leadership has stated that the debt service portion of the tax rate will be evaluated for reduction as RISD progresses into the existing five year bond cycle that began in 2016.

- Why is RISD asking for a 13 cent increase at one time?*

RISD’s current operating tax rate of $1.04 has remained unchanged since 2007-08, when it was lowered to its present level. The operating tax rate was $1.50 in 2005-06. During budget discussions in the months leading up to the approval of the 2018-19 budget and calling the TRE, a majority of RISD Trustees stated that an operating tax rate lower than $1.17 would not be adequate to fulfill the district’s mission into the future.

- Does a lower operating tax rate result in less state funding for school districts?*

Yes. The school finance system is set up to benefit school districts that tax homeowners at a higher operating tax rate. If the TRE is approved, RISD would receive an additional $5.8 million in state revenue annually. Conversely, RISD would lose $3 million per penny in state revenue if its operating tax rate were less than $1.04, in addition to the property tax revenue loss of $1.9 million per penny. The state funding system rewards districts for increased tax effort (a higher tax rate) while reducing state funding as property values increase. The Texas school funding system also lowers the state’s share of RISD funding as a consequence of the district choice to provide homeowners with the local optional homestead exemption.

- Why did RISD not ask for a TRE/higher operating tax rate in 2016 as part of the Bond package or specifically instead of the multipurpose activity centers that were part of the bond package?*

Planning for Bond 2016 began in early 2015, and at that time RISD’s operating tax rate of $1.04 was adequate to meet the district’s needs. An operating tax rate increase was not recommended by RISD financial staff as necessary at that point. Since that time, property values in RISD have risen to historically high levels, which under the school finance formula has accelerated the reduction in the state’s current and future share of operating funds for RISD. This is a major factor in the Board’s decision to request an operating tax rate increase.

The four multipurpose activity centers were approved by voters at a total combined cost of $59.9 million, which equates to 13.7% of the total package of Bond 2016 capital items. Approval of Bond 2016 required an additional 5 cents of debt service tax effort. Removing the MACs could have lowered the impact on the debt service tax rate by approximately 1½ pennies, and could not have been substituted for the TRE.- When I sell my house, would the new owner get a tax increase?*

Exemptions are granted to property owners, not the property itself. A person purchasing a property could qualify for different exemptions based on their individual situation. Every homeowner in RISD qualifies for the standard state homestead exemption and RISD’s local optional homestead exemption.

- If the TRE passes, when would the higher operating tax rate take effect?*

It would take effect with the current year property taxes. Tax bills are expected to be mailed to property owners in November 2018.

- If the TRE is successful, could RISD phase in tax rate increase 3 cents a year up to the $1.17 rate?*

If the TRE passes, the District would not be permitted to phase in the tax increase. The law governing school district maintenance and operations tax rates requires the board to adopt a rate, then ask voters to ratify (approve) it if it exceeds the previous year’s rate.

- How does the TRE impact 2018 tax bills?

The RISD Tax Office is delaying 2018 tax statements until after the November 6 election. This decision was made to avoid the taxpayer confusion that would come with potentially issuing two separate tax statements with different rates and levies. The tax office website will be updated and tax statements mailed the week of November 12. As always, taxpayers will be able to view their taxes and pay their RISD property tax bill through the tax office website.

RISD taxpayers with questions about their property taxes are encouraged to contact the RISD Tax Office at 469-593-0500.

Texas School Funding & Loss of State Funds

- My home value keeps rising so I am paying more school taxes. Why is RISD asking for more money?*

Unfortunately, the way school finance in Texas is set up by the legislature, while increases in RISD home values do cause a homeowner’s school taxes to rise, the increases do not provide an ongoing benefit to RISD’s operating budget. It actually has the opposite effect. As RISD collects more money from local taxpayers due to increased property values, state operating funding for RISD decreases. In fact, state officials have often used the benefit of additional local tax dollars generated in school districts like RISD to fund other parts of the state budget unrelated to public education.

- How much funding would the TRE generate?

Raising the proposed operating tax rate to $1.17 would generate approximately $24.8 million annually for RISD to be able maintain programs and staffing levels, and fund competitive salaries and strategic planning priorities. This would provide RISD the funding level needed to fulfill its mission and meet community expectations of a quality education for every student.

- How much has state funding decreased?

Over the last five years, RISD’s funding from the state has decreased $16.1 million and is projected to decrease an additional $41.8 million over the next five years. This decreased funding directly contributed to RISD adopting a deficit operating budget in 2017-18.

- Why does state aid/funding to RISD continue to go down?*

Under the Texas school finance system, as property values in a school district rise, the state share of school operating funds declines. As RISD has reached a point of historically high property values, the state’s contribution is projected to continue to decrease. This is an intentional design of the school finance system in Texas.

- What does the state do with the savings resulting from reduced education funding to school districts as a result of rising property values?*

This savings has amounted to billions of dollars statewide and the state can use the funds for whatever part of the state budget that the legislature decides.

- How much would RISD have to cut if the TRE doesn’t pass?

If the TRE doesn’t pass, RISD would face a projected operating deficit of $54.1 million over the next five years. This amount assumes 2 percent annual inflation for non-payroll expenses like utilities, fuel and supplies, and assumes no increases in teacher/staff compensation or number of employees.

- Would RISD have to pay the state recapture on funds generated through an increased tax rate?*

Yes. Because of a complicated school finance system, recapture (also known as Robin Hood) requires some school districts to pay a portion of the property taxes collected to other districts in Texas that the state considers to be “property poor.”

If the TRE is successful, RISD would pay approximately $5.8 million annually in recapture, while retaining approximately $24.8 million to use in support of RISD students and staff.- If the school finance system is broken, why doesn’t RISD wait for the Texas legislature to fix it instead of asking for a tax rate increase?*

Like many other school districts, RISD and Trustees have been waiting for years for the state legislature to fix the way schools are funded in Texas. The basic structure of the Texas school funding formula was last comprehensively addressed in 1984.

Trustees adopted a $6.3 million deficit operating budget last year in order to give legislators in the 2017 session more time to address the issue, which they eventually failed to do, again. The next legislative session will occur in 2019, and clear indications have come from elected officials that no state financial relief will be allocated for schools unless they were impacted by Hurricane Harvey. With RISD facing another deficit budget and the need to fund priorities like teacher retention, school safety, and services for students with special needs, Trustees felt they could wait no longer to ask the community to raise the district’s operating tax rate, which is currently at a 27 year low.- What needs to be done for the state to pay more to schools?*

Elected officials within the state legislature would need to change the laws that define the funding formulas for school districts. They would also need to adopt a state budget that provides the funding.

- Does a lower operating tax rate result in less state funding for school districts?*

Yes. The school finance system is set up to benefit school districts that tax homeowners at a higher operating tax rate. If the TRE were successful, RISD would receive an additional $5.8 million in state revenue per year. Conversely, RISD would lose $3 million per penny in state revenue if its operating tax rate were less than $1.04, in addition to the property tax revenue loss of $1.9 million per penny. The state funding system rewards districts for increased tax effort (a higher tax rate) while at the same time reducing state funding as property values increase. The state school funding system also reduces the state share of RISD’s funding as a consequence of the district choosing to provide its homeowners with a local optional homestead exemption.

- At what taxing level does state funding maximize?*

Under the school finance system, state funding to school districts maximizes at $1.06. Additional revenue generated per penny from $1.07- $1.17 would be local tax revenue.

- What has the assessed increase in overall property values been from 2007 to 2018?*

2007-08 was the last time the operating tax rate changed (it was reduced to the current $1.04 from $1.33). Since that time, the total amount of taxable assessed property values has increased $4.6 billion, an increase of 27% over that 11 year period.

Unlike cities and counties, school districts in Texas do not receive an ongoing benefit from operating tax revenue generated through increases in property values. As higher property values result in increased taxes collected, the state of Texas reduces operating funds to schools the following year. This creates a situation where the ongoing operating benefit of higher property values benefits the state of Texas, and not school districts, and causes the local share of funding schools to continue to rise while the state share continues to decline.- Is there some means of raising money for RISD without sending a percentage to Austin?*

The most significant source of alternate funding for school districts are grants. RISD continues to be aggressive in pursuing federal and state grants. As a portion of RISD’s $320 million operating budget, grant funding contributes approximately 6%. It’s important to note that most grants, by nature, are limited in scope to specific areas and are also finite in length. This means that funds allocated from grants toward salaries or programs may later require the district to find alternate funding or consider eliminating the associated staff positions or discontinue the grant-funded program.

Otherwise, there are no alternate sources of recurring operating funds that RISD could use to fill the existing and projected operating deficits outside of the Texas school finance system. Revenue from facility rentals and stadium advertising represent less than one percent of the operating budget.- Hasn’t the state reduced operating funding to RISD just two times in ten years (2012-13 and 2016-17)?*

From 2007-08 through 2016-17, state funding has declined 4 times: 2008-09, 2009-10, 2012-13 and 2016-17.Because property values in RISD have risen to historically high levels, state funds to RISD are projected to decrease each of the next five years.

- If RISD’s operating budget only receives the benefit of increased taxes collected from increased property values for one year, would RISD only be able to keep the funds that would come from the TRE for one year?*

No. RISD would receive the recurring benefit of additional operating funds generated from the TRE, approximately $24.8 million per year. Under the current school finance system, reductions in the state share of funding to districts occur primarily as property values rise across a district, not when tax rates rise.

- If RISD does not benefit from higher property taxes, explain how revenues/budgets could have increased, and why lower revenue is projected in future years?*

RISD does benefit from higher property taxes. RISD does not receive a recurring benefit to the operating budget from higher property values. When property values increase, state operating funding decreases in the following year.

The amount of funding school districts receive is impacted annually by student enrollment, student demographics, and the services students receive, such as special education, Career & Technical Education, free or reduced lunch, bilingual, and gifted & talented. Additionally, in some years prior to 2017, the State Legislature modified the school funding formula to provide some districts with more funding, even as property values increased. The legislature did not provide additional funds to RISD in the 2017 legislative session and RISD cannot predict when or if lawmakers will provide additional funds in the 2019 session or beyond. For this reason, the operating budget and future year budget projections are prepared using the current funding formula.

State funding has grown in the past due to the overall increase in the RISD’s student population and the increase in services students require as well as legislative changes to the funding formula in 2015 and prior.

Lower revenue is projected in future years because property values have reached historically high levels and under the Texas school funding formula, that decreases the amount of recurring funding the state contributes to school districts. RISD’s budget has increased annually for three primary reasons: annual salary increases for teachers and staff, increased utility costs, and additional staff members to serve RISD’s student population that has grown approximately 15% over the last decade.- What measures are being taken to ensure the Texas Legislature takes action on school finance next session?*

RISD works with legislators who represent all or part of RISD to draft and to support legislation that will increase the state’s share funding to RISD. Additionally, RISD, as a member of the Texas School Alliance, Texas Association for School Administrators, Texas School Board Association, Richardson Chamber of Commerce, Dallas Regional Chamber and the North Dallas Chamber of Commerce collaborates with various civic groups to inform legislators about the urgent need to have a school finance system that keeps tax dollars intended for public schools in public schools.

District Finances

- How does RISD compare to other districts when considering academics and spending levels?

In 2017, RISD was one of just 46 public school districts in Texas to receive five stars for strongest academic progress combined with lowest spending relative to other school districts by TXSmartSchools.org.

- How does RISD’s operating tax rate compare to other school districts in the area?*

Among the 38 school districts in Dallas and Collin counties, RISD’s $1.04 operating tax rate is among the lowest, along with the other 12 districts that have not passed TREs. Voters in the other 25 school districts in the area have passed TREs over the last decade, and those districts have operating tax rates of $1.12 (1 district), $1.14 (2 districts) or $1.17 (22 districts).

If the TRE were to pass, RISD would become the 23rd of the 38 districts with an operating tax rate of $1.17 and the 26th to have passed a TRE.- How does RISD’s total tax rate compare to other school districts in the area?*

Among the 38 school districts in Dallas and Collin counties, RISD’s current combined tax rate of $1.39 ($1.04 + $0.35) ranks among the lowest in the area, at 31. If the TRE were to pass, RISD’s combined rate of $1.52 ($1.17 + $0.35) would move RISD’s rank to 18 among area districts.

Important to note: When comparing actual school taxes paid by homeowners, RISD’s taxes levied are lower because it is one of only three districts to still provide a local optional homestead exemption. (See FAQ on local optional homestead exemption.)- What is RISD’s current financial status?

The district is recognized for its fiscal responsibility. It has earned the highest stand-alone bond ratings awarded to Texas school districts by Standard & Poor’s (AA+) and Moody’s (Aaa). These dual top ratings are shared by just three other Texas districts.

In addition, the district has received the highest possible rating from the Texas Education Agency’s Financial Integrity Rating System of Texas each of the 17 years since the rating’s inception.

Due to decreased state funding and its 27-year low operating tax rate, RISD is no longer generating enough operating revenue to achieve its mission and was forced to use one time reserves to adopt a $6.3 million deficit operating budget last year.- What percentage of RISD’s budget is spent on central administration?

In RISD’s most recent adopted operating budget (2017-18), 2.66% of expenditures were allocated to central administrative functions. RISD compares spending in different areas to other school districts to identify opportunities for savings and efficiencies. The central administration portion of RISD’s operating budget is consistently lower than the average of area school districts.

- What determines how much operating money is spent per school?*

Several variables impact how much operating funds are spent per school, but the most significant factor that accounts for differences in per-student funding between schools is student enrollment. Schools with higher enrollments will typically have lower per-student costs than schools with lower enrollments.

All schools have some fixed costs that do not vary based on how many students are enrolled. Elementary schools typically have one principal, one nurse, one counselor, and a librarian. Some front office staff positions are based on enrollment, and energy & custodial costs are based on the school’s physical size. So schools with higher enrollments divide the fixed costs by more students, resulting in a lower per-student costs.

RISD has long been committed to neighborhood elementary schools, and enrollments fluctuate with population and neighborhood trends over years. This results in some schools having significantly higher enrollments at points in time than other schools, but the fixed costs referenced above typically do not change as enrollment increases or decreases. Other staff positions, such as the number of teachers at a school or number of assistant principals, are directly tied to enrollment and will increase or decrease as enrollment fluctuates. When evaluating total funding spent per school, the higher- enrollment schools typically receive the most funding, but per student expenditures are lower because of the fixed costs that all schools share.

Other factors contributing to differences in per-school spending include the different programs/services offered between schools, and the percentage of students who are economically disadvantaged.- What budget reductions has RISD already made for 2018-19?

RISD consistently seeks ways to reduce costs and bring efficiencies to operations. As part of budget and curricular planning this past year, RISD identified several operational and organizational changes that generated a $3.2-million cost savings, allowing the district to pursue instructional initiatives designed to help students without adding dollars to the budget. In addition, central operational cuts have been made to save $600,000 for 2018-19 and beyond.

- Was a lower tax rate increase considered?*

Yes. Trustees considered different operating tax rate increases and evaluated the needs and priorities that could be funded at varying rates, up to a 13 cent increase. An operating tax rate increase of 13 cents was recommended by Dr. Stone as the only level that meets RISD's projected budget needs over the next five years related to class sizes, teacher retention, school safety, services to students with special needs, maintaining academic programs, and implementing priority recommendations from the community & staff strategic planning process.

- Can RISD charge monthly fees to all students in order to generate more revenue?*

No. The right to a free public education is guaranteed by the Texas Constitution, so school districts cannot charge a fee for students to receive that education.

Fees for students to participate in co- and extracurricular activities (such as athletics and fine arts) are permitted under state law. Fees are currently associated with some fine arts activities, and additional co- and extracurricular fees would be among the options that RISD would evaluate if the TRE is not successful.- Why did the district accelerate bond issuance in 2017?*

The district has a history of accelerating the issuance of bonds to meet the cash flow needs of bond projects as well as to take advantage of favorable market conditions. As the district did in 2003 with the 2001 Authorization and the 2007 issuances from the 2006 Authorization, the 2017 bond sale accelerated the issuance of bonds from the 2016 Authorization to take advantage of near historically low interest rates. The bond repayment schedule was structured to maintain the district’s 25 year repayment schedule and allow for the issuance of the remaining authorization at the $0.35 debt service tax rate that was part of the 2016 Bond election proposal. The district will take advantage of increasing property values for the debt service fund by repaying bonds early to create capacity and flexibility in advance of an anticipated 2021 Bond Program.

- Why did the RISD Board not split up the Bond 2016 referendum into multiple parts?*

In 2016, the RISD Board called a single bond referendum, consistent with bond packages put before RISD voters over the last three decades.

- What is the long term risk of passing a deficit operating budget using one time funds generated through year by year increases in property values?*

Under the current state funding formula, the long term risk is that a district would have to continue to utilize reserves or eventually make budget cuts. Since 2004, RISD has adopted five deficit operating budgets. In two of those years the district incurred an actual deficit and one of those two years involved a decrease in property values. There are many factors that impact whether or not a district will incur a deficit when one is or is not budgeted. As an entity whose revenue and required services are significantly controlled by the State, there is always risk that legislative action could have a negative impact on the budget. That is why the RISD Board of Trustees requires the CFO to prepare a five year projection when preparing an operating budget to be adopted so trustees can have as much information as possible when determining the appropriate level of expenditures to meet the needs and expectations of the students, staff and community.

As a financial strategy, some schools districts utilize one time funds to balance operating budgets and some do not. Using the one time funds generated through increased property values via the Texas school finance system for operating costs is known as “budgeting into the lag” because there is a one year lag between the time that school districts collect increased taxes due to values and when the state reduces its portion of funding. The strategy relies upon property values continuing to increase each year at a rate equal to or greater than the amount budgeted. If property values do not increase each year accordingly, then a district does not have the operating revenue to continue to fund the items paid for with one time funds, and would face a deficit to continue funding existing programs or staff positions.

RISD has traditionally not budgeted “into the lag” under the current school finance system, however, trustees did so in 2017-18 in order to provide a teacher and staff pay increase. Using one time funds for operating purposes is not a sustainable strategy over the long term, and will eventually require either increased revenue and/or a reduction in expenditures (budget cuts).- Which RISD extracurricular programs do not currently require a fee to participate?*

RISD extra-curricular programs do not currently require a fee to participate. RISD provides equipment, transportation and coaching/instruction to students participating in extra-curricular activities such as athletics and fine arts. Many parents of students in programs/activities choose to purchase specialized or extra equipment related to the activity for their child to use and keep. Fees from parents are currently requested in some programs, such as band, drill teams and cheerleading. Fees are requested in order to help provide a higher quality experience for the students participating, and for the programs be able to perform at a level consistent with parent and community expectations. For example, RISD marching bands are competition-caliber band programs with ongoing goals of competing and performing well at state UIL competitions.

- How much does it cost RISD to send birthday cards to some residents?*

The Silver Advantage discount card is available to RISD residents age 55+ and can be used to attend RISD athletic and fine arts events. In 2016, RISD began mailing residents who had signed up for the Silver Advantage card a donated student artwork card on their birthday as a reminder that they can use their Silver Advantage card to attend RISD events. Last year, the cards cost approximately $202 to mail to the residents who signed up.

- If the TRE is successful, will programs that have been cut in recent years be revived?*

The Board has discussed and voted on operating expenditures for the current 2018-19 school year. Some expenditures in the current year, such as the teacher and staff salary increase, is contingent upon sufficient operating funds being available through passage of the TRE. Decisions about operating expenditures in future years that could be used to reintroduce previously-cut programs will be the result of future budget planning efforts and based on operating funds available in future years.

- What exactly does “implementing the strategic action plan” mean?*

The school year-long strategic planning process, completed in April of 2018, produced a number of results, including some with budgetary implications. During the planning process for the 2018-19 operating budget, the highest priority recommendations from the strategic planning action teams were included, such as a teacher pay increase and increased security personnel. A number of strategic planning recommendations that would impact future budget years have yet to be approved by the Board of Trustees, which is a necessary step in the vetting process. The potential timelines and projected costs of implementation of strategic planning action team recommendations is variable, based on Board discussion and approval of each recommendation that includes a budgetary impact, as well as operating funds available in future budget years.

The Board discussed specific Strategic Plan Action Team recommendations and an initial timeline at its September 10, 2018 meeting. The Board will continue to discuss the many specific Strategic Plan Action Team recommendations at meetings throughout the 2018-19 school year.- Does RISD have agreements with businesses to offer property tax abatements or reduced property taxes as part of a business locating or operating within district boundaries?*

No, RISD has no agreements with any specific businesses or other commercial entities to offer a reduced tax levy. RISD does offer a local optional homestead exemption to all homeowners that reduces the amount of taxes levied. School districts are no longer permitted to offer tax abatements to businesses under current Texas law.

RISD is part of the Skillman Corridor Tax Increment Financing District (TIF), managed through the City of Dallas, and contributes debt service tax collections from properties in specific, limited areas targeted by the TIF for redevelopment in the Lake Highlands area. RISD trustees agreed to participate in the TIF in 2005, and the agreement does not impact RISD’s operating funds or operating budget.- If RISD is not legally permitted to offer tax abatements to businesses, why is there a difference between the market value and taxable value of commercial/business properties on the RISD tax rolls?*

The difference between market value and taxable value for commercial and business personal property is due to statutory exemptions granted by the state. Under the exemptions granted by state law, property owned by government, public and certain types of non-profits are included in overall assessed market values but not in taxable values. Only properties with a taxable value can generate revenue for RISD.

- How much was spent on purchasing the property on White Rock Trail and tearing down the existing structure? What are the continuing costs of owning that site?*

The district property at White Rock Trail & Walnut Hill was purchased for $4,474,997. Demolition of the existing structure and associated work to bring the property to its present condition cost $892,273. The costs of ongoing maintenance include cutting the grass and removing debris, which is done by existing RISD grounds staff as they rotate through RISD’s 70+ facilities. There are no other costs associated with owning the site.

The site is currently in the process of being sold. After closing costs and fees, RISD projects a net profit of approximately $87,000.- What items were requested by the district for the 2018-19 operating budget that the Board did not include?*

The following are major cost items requested/considered and not approved in the 2018-19 budget:

- 40.5 additional special education staff positions

- 16 Junior High Coaches - 1 boys and 1 girls per junior high

- 4 Campus Athletic Secretaries

- 4 Strength and Conditioning Coaches

- 4 High School Coaches

- Increased Athletic Stipends for coaches

- 11 Elementary Teachers

- 4 Elementary Counselors

- 6 Secondary Teachers

- 10 facilities/grounds crew staff

- 2 HVAC Technicians

- 7 Custodians

- Newcomer Center Director

- Additional Assistant Principal at PHS

- Elevation Coordinator

- Communications Staff

- ACE Program Specialist

- Xplore Coordinator/Recruiter

- Alumni database

- Advertising and branding initiatives

- Technology Engineer

- Replace all Campus PA systems

- Door replacement project

- 3 Student Services staff

- Options to offset health Insurance premiums for employees

- Options to provide one-time experience stipends for employees

- Increase new teacher starting salary

- Did the RISD Board spend $8 million in operating funds to expand the scope of the multipurpose activity centers that had been approved by taxpayers in the 2016 bond at a smaller scope?*

No. The Board approved up to $2 million in additional funding to add space at each of the four multipurpose activity centers (MACs). The actual cost for the first three centers is $360,000 more per facility compared to the amount approved by taxpayers.

Bond 2016 was approved by taxpayers in May 2016 and included funding for a multipurpose activity center at each of the district’s four high schools. The scope, as approved at a projected cost of $14.98 million each, did not include funds or space for locker rooms, or work space for coaches or staff. During the design stage of the projects in December 2017, RISD’s Athletics and Fine Arts departments requested that the board consider adding 8,000 square feet of space for locker rooms and work space for staff to accommodate the needs of these growing programs. Board members discussed and agreed to use up to $8 million ($2 million per MAC) of one-time operating funds for this one-time purpose to meet the needs of students participating in extra-curricular programs.

In August 2018, the Board agreed to a guaranteed maximum price of $46.01 million ($15.34 million each) for the first three multipurpose activity centers, which is includes the additional 8,000 sq/feet of space. The fourth center is part of a larger classroom expansion project at LHHS. The guaranteed maximum price for the LHHS project, of which the LHHS MAC is a portion, is expected by the end of the year.- When the Board approved up to $8 million to make the four multipurpose activity centers larger, what account was the funding designated to come from?*

In December 2017, the RISD Board approved up to $8 million in one-time funds to increase the size/scope of the four multipurpose activity centers approved by voters in the 2016 bond. The actual cost of the size/scope increase for the first three centers was $360,000 each. (See separate FAQ)

While the funds were not designated by the Board to come from a specific fund, the $1.08 million in additional funds, when paid, will come from the local capital projects fund.- Have there been cost overruns related to the multipurpose activity centers?*

No. In December 2017, the RISD Board discussed and approved funding for multipurpose activity centers (MACs) with an expanded scope (more space and features for students) than originally approved by voters in the 2016 Bond. The additional cost approved by the Board for the larger scope was up to $2 million per facility (see separate FAQ). In August 2018, the district’s guaranteed maximum price for the first three MACs reflected the actual additional costs of $360,000 per center.

To this point in the design and construction process of the MACs, there have not been any unanticipated costs or overruns exceeding the budget approved by the Board when the scope was expanded.- Did RISD overestimate revenue during planning for the 2017-18 operating budget?*

Yes. In the spring of 2017, RISD initially underestimated how many taxpayers would receive the exemption for homeowners who are 65 or older. This resulted in an overestimation of available revenue during part of the budget planning process. The overestimation was corrected later in the budget planning process and Trustees approved the 2017-18 operating budget based on the more accurate revenue estimates.

- Is RISD obligated to spend the additional revenue from a successful TRE on the items indicated in the informational materials?*

The RISD Board of Trustees has already passed the current year (2018-19) operating budget, that includes expenditures contingent upon passage of the TRE. If the TRE is successful, then those expenditures will be funded. If the TRE is not successful, then the Board will work to determine how to reduce and balance the 2018-19 operating budget.

- When will state funding equal zero? How does decreased state funding contribute to a net loss?*

State funding would equal zero when the property value per weighted average daily attendance (WADA) exceeds $514,000. Based on current estimates that would not occur until sometime after the 2022-23 school year, and would require property values to continue to rise.

A decrease in state funding contributes to a net loss in the same way that any other decrease in funding can contribute to a net loss. During the budget planning process in 2017-18, RISD trustees made an intentional decision to use one time funds to operate at a deficit in order to provide teachers and staff with a salary increase. School districts will at times make a conscious decision to run a deficit for a year, just like citizens will at times use savings to pay for a recurring cost in their budget. The use of savings is not a sustainable long term strategy.- Why have some previous years’ financial forecasts for RISD’s operating budget been off? What are the variables considered in budget planning?*

As part of budget planning efforts each year, RISD policy requires the CFO to prepare budget forecasts five years into the future. Many variables impact budget planning and forecasts, including property tax values and potential legislative action that are difficult to accurately predict. For those reasons, the later years of the required five-year budget forecasts can be less reliable than earlier years. Maintaining a rolling five-year budget projection is a useful exercise for the district and board to make the most informed decisions possible related to staffing and compensation.

Some variables that can significantly impact state revenue budget projections:- In every 5-year projection period there will be two legislative sessions. Budgets are always prepared using current law at the time of adoption. Since July 1, 2007 there have been five changes to the basic allotment, six changes to the Level 2 guaranteed yield and two changes to the Level 1 equalized wealth level. Each legislative change impacts the variables used for budget forecasts.

- The number of students and their rate of attendance.

- The number of students receiving special education services and the types of services they receive.

- The number of students in Career Technology classes and the category of those classes.

- The number of students receiving free or reduced price lunches.

- The number of students who are pregnant, bilingual, or receiving gifted and talented services.

- The number of full and part-time employees excluding certain categories.

These variables can significantly impact forecasted property tax revenue:

- Taxable property values

- Tax collections rates

- Tax levy

- Tax levy lost due to homeowners 65 and over

Taxable values in RISD decreased in fiscal years 2009-10, 2010-11, and 2011-12. Taxable values increased 0.9% in 2012-13 and 2.84% in 2013-14. From 2014-15 through 2017-18 taxable values rose 4.5%, 4.8%, 9.92% and 8.9% respectively)

The following variables can significantly impact forecasted expenses:

Salaries (90% of RISD’s operating budget)- Occupancy rate for all positions

- Salary for positions that will be filled during the year that were vacated during the year

- Length of time positions are vacant

- Number of positions needed across schools and departments to provide services in a given year

Utilities

- The variable nature of weather and the needs associated with heating and cooling schools and facilities over a given year

- Cost of gas and other fuels to generate electricity

- Cost of fuel for buses and district vehicles

- Why doesn’t the school board budget with a cushion (margin for error)?*

A margin for error is built into the operating budget due to the number of variables the revenue and expenditure budgets are based on. (See FAQ on budget variables for more information)

- Did RISD get some funds from the Dallas County Schools dissolution?*

Yes, RISD received $1.46 million in one-time funds through the DCS dissolution. The funds are being used to help offset costs related to RISD providing student transportation in-house (drivers, staff, bus maintenance/repair, etc.).

- If taxpayers live within a budget based on funds available, why not the school district?*

RISD has been budgeting within funds available from the $1.04 operating tax rate since the district’s operating tax rate was reduced to the current level in 2007-08. The operating tax rate was last raised in 1991 (27 years ago) when it was increased to $1.50.

Ninety percent of RISD’s budget is comprised of salaries, and as the district has grown and salaries have risen (between 0-3% a year since 2007-08), the operating budget has grown. The RISD Board president has stated that the district can no longer fulfill its mission operating at the same $1.04 tax rate, and that is the reason that voters have been asked to consider an increase.- What is the reason that expenses in RISD have increased over the last five years?*

The Texas legislature cut funding to all school districts from 2010-12. During that time, RISD implemented a hiring freeze and did not provide salary increases to teachers or staff, among a number of measures to reduce spending. When the cuts were partially restored in 2013, RISD again provided salary increases to teachers and staff in order to attempt to remain competitive. The period has also overlapped with a period of significant student enrollment growth, which requires additional teachers and staff members to provide services.

The three areas responsible for increases in operating expenditures over the last five years include salary increases for teachers and staff, the addition of employees to provide services to students, and the rising costs of energy/utilities.- Why is the inflation rate used in projected future costs 2% when this year’s rate of inflation is 2.7%?*

An inflation rate of 2% was chosen as the average of the inflation rate for 2016-18.

- How many staff raises has RISD budgeted over the next five years?*

RISD’s current 2018-19 budget, adopted in June 2018, includes a 2.5% raise for teachers and staff. Budget decisions for future operating years have not been made. Budget planning discussions for specific years typically begin in the winter, leading up to a June budget adoption.

RISD’s goal is to attract and retain quality teachers and staff, in part through competitive salary. While specific budget discussions have not yet begun for operating years 2019-20 and beyond, strategic planning recommendations include offering competitive salaries for teachers and staff, and that is also a long-term district and board priority.- Why was the Operations Center built?*

The RISD Operations Center was built to consolidate a number of district functions and departments that had outgrown previous locations. It is located at 1123 S. Greenville Avenue, across from Restland cemetery, and was constructed on land that RISD already owned. District operations located at the facility include transportation, facilities services, grounds and maintenance, warehouse, mailroom, print shop, testing, athletics and fine arts. The Operations Center also houses maintenance and fueling stations for transportation.

The RISD “bus barn,” where RISD’s 160+ school buses are parked and student bus routes originate and end, has remained at the same location at 900 S. Greenville for more than 30 years.

Fund Balance

- Has RISD considered using more of its excess fund balance to offset the operating shortfall?*

Yes. Last year RISD adopted a $6.3 million deficit budget using reserves. Currently, the fund balance is projected to be at 25 percent of expenditures for the 2018-19 school year, which is the lowest it can go and still comply with district financial policy.

A large portion of fund balance is used by school districts to operate for the first part of each school year, until tax revenues are received mid-year. In addition, the Texas Education Agency and bond rating agencies recommend that school districts maintain a fund balance reserve of at least 25 percent as a fiscally prudent measure to guard against unforeseen financial circumstances. The 25 percent fund balance would enable RISD to operate and fund expenses for approximately three months.

Student Enrollment

- Are more parents choosing RISD?

Yes. Since 2008, RISD student enrollment has grown by more than 5,200 students - a 15 percent increase that places RISD among the higher-growth districts in North Texas. More parents are choosing RISD, and homes in the district continue to be sought out by families seeking a quality education and strong community. RISD’s Bond 2016 was planned in large part to accommodate the physical needs associated with increased enrollment through new classrooms, facilities, and projects that provide more space for instruction and growing extra-curricular programs in Fine Arts & Athletics. The recurring costs associated with enrollment growth, such as salaries for teachers, are funded through the operating tax rate that the TRE would impact.

Part of the reason the Board has called a TRE is to maintain the programs that have made RISD a district of choice for parents and families. Families choose RISD for:- High quality and well-trained teachers

- Advanced academic programs and options

- Reasonable class sizes

- College and Career Readiness options, including a variety of researched and industry-targeted Career and Technical Education (CTE) options that allow students to earn industry licenses and certifications by the time they graduate

- The instructional support and commitment to meet the academic needs of all students, regardless of ability, family income, or special needs.

- What are RISD’s class sizes vs comparable districts?*

RISD does not have comparable class size data from other school districts. The way class sizes are calculated by the state of Texas is not useful for benchmarking purposes, because the state considers more staff members than actually teach in a classroom, so class sizes appear lower than they actually are.